That rotable collecting dust in your stockroom? It’s not just sitting—it’s silently draining your budget.

Operators often forget that inventory isn’t just parts—it’s tied-up capital. And unless that capital is moving, it’s not helping you fly.

One Operator’s Wake-Up Call

We recently assisted a regional airline in cleaning out its main warehouse—initially to create space for a new repair intake process.

They didn’t think they had much value tied up. But once we got into their bins, it was a different story.

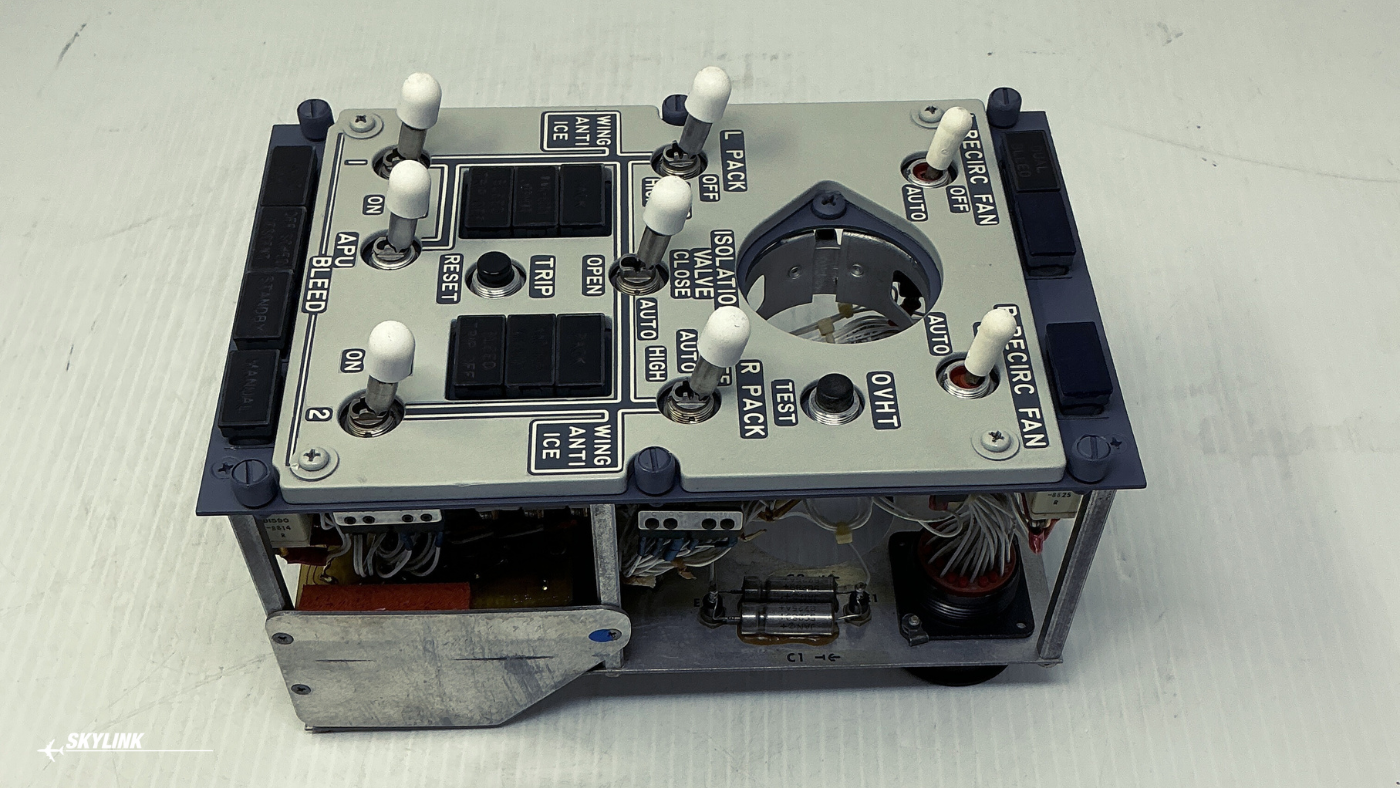

It turns out they were sitting on over 200 surplus rotables—most of which were from a fleet type they had phased out.

Still tagged, still certified, but just sitting there, burning space and budget.

We conducted a comprehensive trace validation, cleaned the data, and assisted them in building a resale batch with realistic market pricing.

Within three weeks, they'd recovered hundreds of thousands of dollars in working capital.

No scrambling. No complicated RFP. Just strategic liquidation—followed by smart reinvestment into upcoming heavy maintenance checks for their active fleet.

They moved from “We should probably get rid of some of this” to “Why weren’t we doing this every quarter?”

This isn’t an outlier. It’s what happens when you treat surplus like a financial lever instead of dead weight.

The Real Cost of Surplus Aircraft Part Inventory

Holding onto surplus aircraft parts feels safe. “We might need it,” someone says. “Let’s hold one more just in case.”

But every item sitting on the shelf comes with a hidden tax.

First, there’s storage and warehousing—especially if you’re leasing space or paying to expand capacity.

Then there’s insurance, which is often calculated off declared value, regardless of whether that value is still real.

Over time, as these parts sit, they also face depreciation, condition drift, and obsolescence—especially for legacy platforms or when PMA/OEM availability shifts.

And then there’s opportunity cost.

That $50,000 sitting in surplus could be covering your next C-check.

It could be eliminating an open PO backlog. It could be funding a forward kit strategy that cuts AOG response times.

Surplus isn’t a safety net. It’s a slow leak.

A Smarter Way to Sell Your Surplus

Liquidating surplus isn’t about dumping your inventory—it’s about recovering its value strategically.

1. Start with a material audit.

Pull data on what hasn’t moved in 12–24 months.

If it hasn’t turned and it’s not planned for a mod, check, or a future AOG, it’s probably not needed.

Group by part type, value, condition, and trace status.

Pay close attention to serialized rotables with clean paperwork—these will move faster and command higher returns.

2. Prioritize by resale potential.

Focus first on rotables, high-dollar expendables, and parts with active fleet demand.

If it’s traceable, tagged, and in resellable condition, it’s a candidate.

Parts without paperwork, shelf life, or trace? Scrap them before they drag down your teams time.

3. Skip listing sites—use a real partner.

Don’t waste time uploading parts to a site that leads with price and ignores compliance.

Work with a resale partner who knows aviation regulations, validates documentation, and offers consignment or direct purchase.

The right partner will protect your margin and your name.

4. Set realistic floor pricing.

Decide your bottom dollar and stick to it—but don’t chase top dollar at the expense of speed.

Include costs like packaging, re-certification, and freight in your floor.

A fast, fair return beats holding out for a unicorn buyer who never shows.

5. Reinvest the recovered capital.

This is where most operators drop the ball.

Take that cash and put it to work—cover a C-check, stock a forward kit, or close out aging open POs.

Don’t let the money you just freed get swallowed back into operational noise.

From Idle Parts to Active Cash Flow

That operator who cleared six figures in recovered material? They didn’t stop with one cycle.

They built it into their quarterly workflow.

Every 90 days, their team flags stagnant inventory, scrubs it for value, and runs it through a resale funnel.

What was once a warehouse full of “maybe someday” parts is now a revenue-generating engine.

And the cash flow?

It funds C-checks, avoids AOGs, and eliminates budget battles for critical materials.

It’s not just cleanup—it’s strategy.

The Bottom Line

If your parts room looks full but your budget looks thin, your inventory isn’t optimized—it’s bloated.

Surplus should never be an emotional decision. It’s a financial one.

Audit your shelves. Assign value. Sell smart. Then put that capital to work.

Because every part sitting still is a part that could be moving your operation forward.

Want to know what your surplus is really worth?

We’ll do a full review—no fluff, no obligation.